Intertemporal Choice

Christopher Makler

Stanford University Department of Economics

Econ 50: Lecture 11

pollev.com/chrismakler

What song about time is playing right now?

This week: financial economics

Time

Risk

How much are we willing to give up now to have more later?

How much are we willing to pay to mitigate risks?

TODAY

WEDNESDAY

Applications

Inflation

Insurance

Portfolios

FRIDAY

Exercises 5.1, 5.2

Exercises 5.4, 5.5 (Q)

Exercise 5.3, poss. 5.6

I will also be posting a collection of old exam questions later today; solutions to be posted on Friday

Approach: Use Tools of Consumer Theory

- Assume there is some "value function" for consumption \(v(c)\)

- Sort of like an indirect utility function

- Create "utility functions" out of this value function

- Endowment budget constraint: instead of starting with some amount of money \(m\), we're going to start out with a bundle representing an income stream

- Buying/selling becomes borrowing/lending

Budget Constraint

Preferences

Functional forms for utility / value functions:

Cobb-Douglas (decreasing MRS)

Weak Substitutes (decreasing MRS)

Perfect Substitutes (constant MRS)

Concave (increasing MRS)

Today's Agenda

- Modeling present-future tradeoffs

- The intertemporal budget constraint

- Preferences over time

- Optimal saving and borrowing

- Different interest rates for borrowing and saving

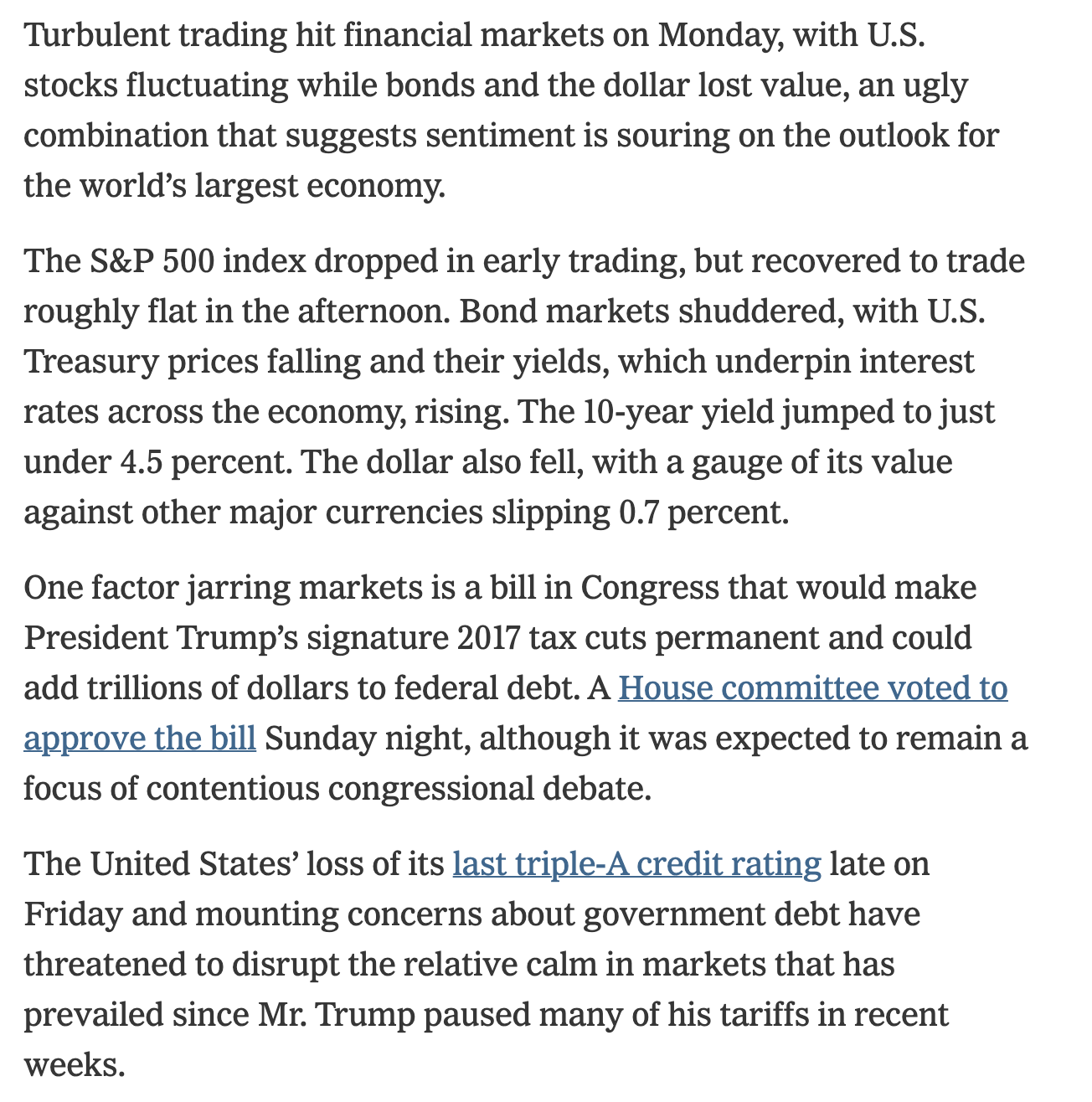

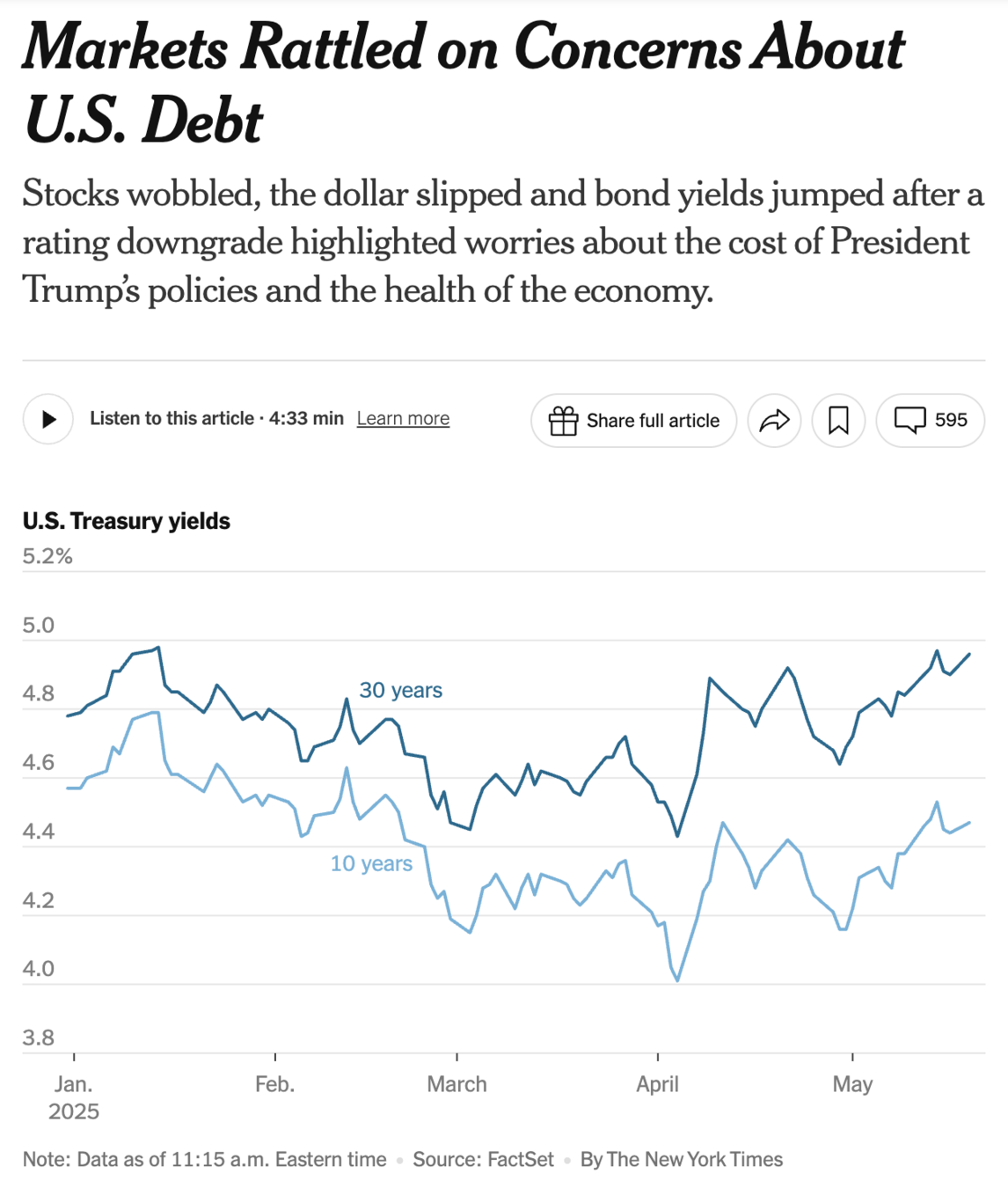

Saving and borrowing is a huge part of the economy.

Budget Line

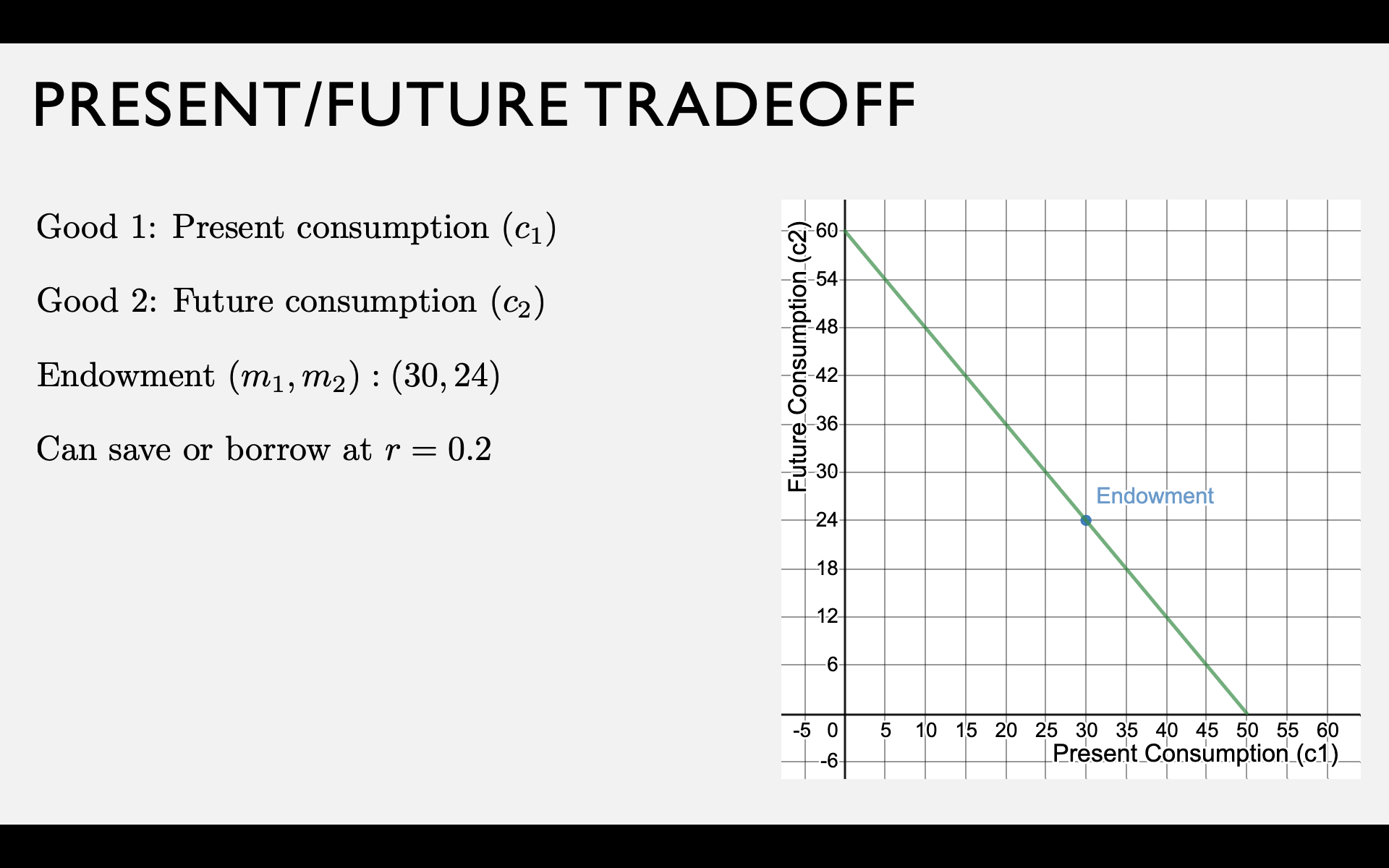

Present-Future Tradeoff

Your endowment is an income stream of \(m_1\) dollars now and \(m_2\) dollars in the future.

What happens if you don't consume all \(m_1\) of your present income?

Two "goods" are present consumption \(c_1\) and future consumption \(c_2\).

Let \(s = m_1 - c_1\) be the amount you save.

Saving and Borrowing with Interest

If you save at interest rate \(r\),

for each dollar you save today,

you get \(1 + r\) dollars in the future.

You can either save some of your current income, or borrow against your future income.

If you borrow at interest rate \(r\),

for each dollar you borrow today,

you have to repay \(1 + r\) dollars in the future.

How much can you consume in the future if you save all your present income \(m_1\)?

How much can you consume in the present if you borrow the maximum amount against your future income?

"Present Value"

Preferences

Preferences over Time

Examples:

When to borrow and save?

Save if MRS at endowment < \(1 + r\)

Borrow if MRS at endowment > \(1 + r\)

(high interest rates or low MRS)

(low interest rates or high MRS)

If we assume \(v(c)\) exhibits diminishing marginal utility:

MRS is higher if you have less money today (\(m_1\) is low)

and/or more money tomorrow (\(m_2\) is high)

MRS is lower if you are more patient (\(\beta\) is high)

Save if MRS at endowment < \(1 + r\)

Borrow if MRS at endowment > \(1 + r\)

pollev.com/chrismakler

If \(m_1 = 30\), \(m_2 = 24\), and \(\beta = 0.5\),

what is the highest interest rate at which you would borrow money?

Borrow or Save?

Optimal Choice

Optimal Bundle

Tangency condition:

Budget line:

If \(m_1 = 30\), \(m_2 = 24\), \(\beta = 0.25\), and \(r = 0.2\),

what is your optimal choice?

pollev.com/chrismakler

Optimal Bundle

Tangency condition:

Budget line:

Since you start with \(m_1 = 30\), this means you borrow 10.

Different Interest Rates

BORROW

SAVE

What if the interest rate is different for borrowing and saving?

Summary

- No new math! We applied the math we've already developed to a new (and important) problem.

- Notion of net demand and net supply: where do you want to trade to from your endowment?

Econ 50 | Fall 25 | Lecture 11

By Chris Makler

Econ 50 | Fall 25 | Lecture 11

We apply the framework of consumer choice theory to the choice of how to allocation money across time, investigating saving and borrowing.

- 495